Find an exciting job opportunity! Join the Federal Tax Ombudsman Secretariat and be part of a great team. Submit your application now! Best of luck! 🌟

About the Federal Tax Ombudsman Secretariat

The Federal Tax Ombudsman Secretariat فیڈرل ٹیکس آنبڈسمین سیکرٹریٹ is an important government organization in Pakistan. This organization helps people solve problems related to taxes and ensures that tax rules are fair and followed correctly. It works on improving the tax system and makes sure that everyone pays the right amount of tax. The main goal is to make the tax system easy, transparent, and fair for all citizens. Simply put, the Federal Tax Ombudsman Secretariat works hard to make Pakistan’s tax system better for everyone!

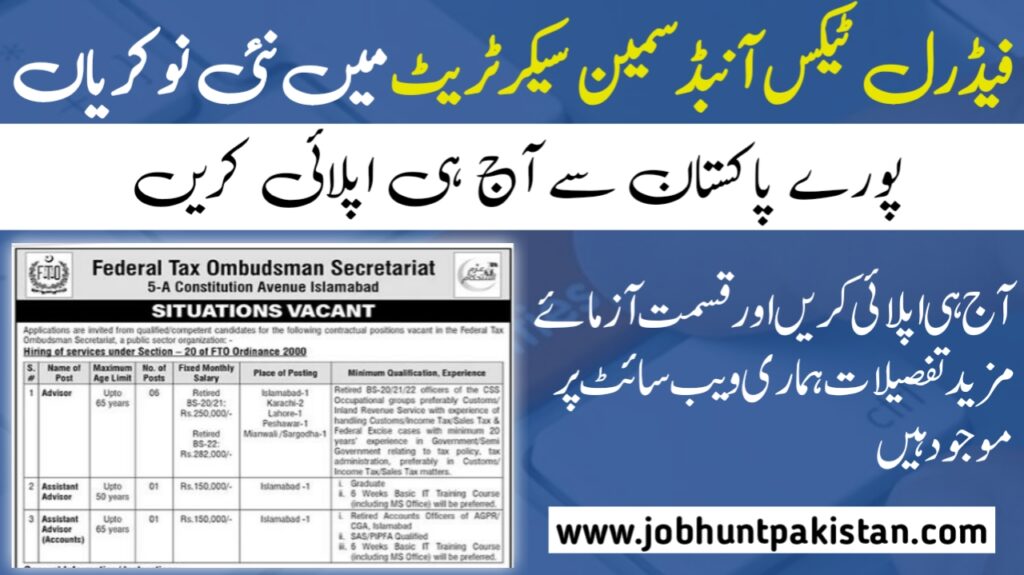

Job Opportunity at Federal Tax Ombudsman Secretariat

The Federal Tax Ombudsman Secretariat فیڈرل ٹیکس آنبڈسمین سیکرٹریٹ invites applications from qualified candidates for various positions on a contract basis. This is a great opportunity for people with experience in tax-related work to help improve the country’s tax system. If you are passionate about working towards a fairer tax system and want to contribute to your country’s growth, we encourage you to apply!

| Date of Posting | 04 December, 2024 |

| Job Offering Organization | Federal Tax Ombudsman Secretariat |

| Work Location | Islamabad |

| Newspaper Add | Dawn |

| Last Day to Apply |

Current Vacancies Available at Federal Tax Ombudsman Secretariat

- Advisor

- Assistant Advisor

- Assistant Advisor (Accounts)

Qualifications and Skills Needed for the Jobs of Federal Tax Ombudsman Secretariat فیڈرل ٹیکس آنبڈسمین سیکرٹریٹ

1. Advisor

- Education: You should be a retired government officer. You must have worked in a big government department like Customs, Income Tax, or Sales Tax.

- Experience:

- You need to have worked for at least 20 years in a government or semi-government job.

- Your work should be about taxes, like handling Customs, Income Tax, or Sales Tax cases.

- Age Limit: You can apply if you are 65 years old or younger.

- Skills:

- You should understand how taxes work and have experience dealing with tax issues.

2. Assistant Advisor

- Education: You need to have at least a graduation degree (a basic university degree).

- Skills:

- You should know how to use a computer, especially MS Office (like Word and Excel).

- If you have done a 6-week basic computer course, that’s good, but not required.

- Age Limit: You can apply if you are 50 years old or younger.

- Experience: No specific work experience is required, but having worked in an office before will help.

3. Assistant Advisor (Accounts)

- Education: You should be a retired officer who has worked in accounts offices, like AGPR (Accountant General Pakistan Revenues) or CGA (Controller General of Accounts).

- Skills:

- You must have a special accounting qualification, like SAS or PIPFA.

- You need to know how to use a computer, and a 6-week computer course is good, but not required.

- Age Limit: You can apply if you are 65 years old or younger.

- Experience: You should have experience handling accounts or money matters.

General Skills for All Jobs:

- Communication: You should be good at speaking and writing clearly.

- Teamwork: You need to work well with others in a group.

- Attention to Detail: Be careful and pay attention to small things.

- Time Management: You must be able to finish your work on time.

These are the basic things you need to apply for each job. Make sure you meet them before applying!

| Job Title | Salary | Place of Posting |

|---|---|---|

| Advisor | Rs. 250,000 – Rs. 282,000 | Peshawar, Islamabad, Karachi, Lahore, Mianwali/Sargodha |

| Assistant Advisor | Rs. 150,000 | Islamabad |

| Assistant Advisor (Accounts) | Rs. 150,000 | Islamabad |

General Information and Instructions

- Contractual Appointment: The appointment will be made purely on a contract basis under Section 20 of the FTO Ordinance 2000, initially for 6 months to 1 year, extendable based on performance.

- Re-application: Candidates who have applied before in response to previous advertisements should apply again.

- Vacancy Adjustments: The number of vacancies may be increased or decreased based on the requirements.

- Submission of Applications: Interested candidates must submit their applications along with one recent passport-sized photograph and relevant documents (qualifications, experience, service group, date of birth, CNIC number, contact number, etc.). The name of the post should be clearly mentioned on the top right side of the envelope.

- Deadline: Applications must be submitted within 15 days from the date of this advertisement.

- Late Applications: Applications received after the deadline, or those that are incomplete, will not be considered.

- Encouraging Diversity: Both male and female candidates are encouraged to apply for these positions.

- Shortlisting: Only shortlisted candidates will be called for a test or interview. No TA/DA will be provided for attending the test/interview.

FAQs About Federal Tax Ombudsman Secretariat فیڈرل ٹیکس آنبڈسمین سیکرٹریٹ Jobs

1. What is the Federal Tax Ombudsman Secretariat?

The Federal Tax Ombudsman Secretariat is a government organization in Pakistan that helps people solve problems related to taxes. It works to make sure that tax systems are fair and right for everyone. 🏛️

2. What kind of jobs are available at the Federal Tax Ombudsman Secretariat?

There are jobs like Advisor, Assistant Advisor, and Assistant Advisor (Accounts) available. These jobs help in managing tax-related issues and working on policies. 💼

3. Where are the job positions located?

The jobs are in different cities, including:

- Islamabad

- Karachi

- Lahore

- Peshawar

- Mianwali/Sargodha

You will be posted in one of these cities based on the job you apply for. 🌍

4. What are the age limits for these jobs?

- For Advisor: Up to 65 years.

- For Assistant Advisor: Up to 50 years.

- For Assistant Advisor (Accounts): Up to 65 years. 🕒

5. How much salary will I get in these jobs?

- Advisor: Rs. 250,000 to Rs. 282,000 per month.

- Assistant Advisor: Rs. 150,000 per month.

- Assistant Advisor (Accounts): Rs. 150,000 per month. 💰

6. What are the qualifications needed for these jobs?

- For Advisor: You need to be a retired government officer with at least 20 years of experience in Customs, Income Tax, or Sales Tax matters.

- For Assistant Advisor: You should have a graduation degree.

- For Assistant Advisor (Accounts): You need to be a retired accounts officer with a special accounting qualification like SAS or PIPFA. 🎓

7. Can I apply if I have not worked in the tax department before?

It depends on the job. For the Advisor position, you need to have experience in taxes, but for Assistant Advisor positions, no special tax experience is needed. 🌟

8. Is computer knowledge required for these jobs?

Yes, it is important. If you know how to use MS Office and have done a basic computer course (6 weeks), it will help, especially for the Assistant Advisor and Assistant Advisor (Accounts) positions. 💻

9. Do I need any special certificates for these jobs?

For the Assistant Advisor (Accounts) job, you need special qualifications like SAS or PIPFA. Otherwise, just a graduation degree is enough for other jobs. 📜

10. Can females apply for these jobs?

Yes! Both males and females are encouraged to apply for these positions. Gender does not matter. 👩💼👨💼

11. How long will I be hired for these jobs?

The jobs are on a contract basis for 6 months to 1 year, but they can be extended based on your performance. ⏳

12. How do I apply for these jobs?

You need to send your CV, photo, and all documents to the address mentioned in the advertisement. Make sure to write the job title on the envelope. 📨

13. What documents do I need to send when applying?

You need to send:

- Your CV

- One passport-sized photo

- Copies of your degrees and certificates

- CNIC (National Identity Card)

- Phone number and address. 📄

14. Is there a deadline to apply?

Yes, applications must be submitted within 15 days from the date of the advertisement. 📅

15. Will there be a test or interview?

Yes, only shortlisted candidates will be called for a test or interview. So, make sure your application is complete! 📝

16. Do I need to pay anything to apply?

No, you do not need to pay anything to apply for these jobs. They are free to apply for! 💸

17. Will I get money for traveling to the test or interview?

No, TA/DA (travel or daily allowance) will not be given for attending the test or interview. 🚗

18. Who can I contact for more information?

You can contact Muhammad Farhan Khan, Director (Admin), at 051-9217767 for any questions. 📞

Job Advertisement – Exciting Career Opportunities at the Federal Tax Ombudsman Secretariat Jobs 2024

Good luck with your job application at the Federal Tax Ombudsman Secretariat فیڈرل ٹیکس آنبڈسمین سیکرٹریٹ🌟! This is a great chance for you to show what you can do and help improve the tax system. Stay calm, stay focused, and remember, you have everything you need to succeed! Keep a positive attitude, believe in yourself, and give it your best shot. We are wishing you all the best on this journey. You can do it! 💪😊